For a growing company with a healthy cash flow, buying an office can be an attractive option. But, even if the funds are available, is this the best financial move for your business? It's important to weigh the advantages and disadvantages of buying or renting an office before making this big decision. Here are some pros and cons to start the discussion:

Which is more profitable, renting or buying office space?

Deciding between renting or buying office space can be a dilemma for many entrepreneurs. The considerations are varied, ranging from strategic location to long-term financial calculations. Here are some things to consider before making a decision.

How long will you be staying in that location?

Financial studies show that, for the short term, renting is more cost-effective than buying. However, if you decide to permanently own a headquarters in a specific location, purchasing property financially will be more advantageous.

Still unsure? Let's take a look at the discussion of factors to consider when buying or renting office space for your business.

Measure how rapidly your business is growing

If your business is booming and you anticipate rapid growth in the coming years, then leasing can provide greater flexibility. You can relocate if your current workspace can no longer accommodate the expanding workload.

On the other hand, if you buy a workspace, it is likely that in the future the building will be too small, or even too large if the business does not meet expectations. As a result, you will have to spend more on maintenance or expansion. The same applies if your business shrinks in the next few years.

In short, leasing can be a smart option if you predict exponential business growth or the possibility of fluctuations in business size in the years to come.

What is the economic condition in your area?

Property investment is now more difficult to predict. It is important to know the consistency of the buying and selling values of an area before deciding to purchase property. If property values are still declining or are too high, leasing may provide advantages such as better locations and protection from potential financial losses if you have to sell the property. leasing mungkin memberikan keuntungan seperti lokasi yang lebih baik dan perlindungan dari potensi kerugian finansial jika kamu harus menjual properti.

Know the types of businesses allowed to buy property in Indonesia

Having plans to expand your business in Indonesia certainly has its own challenges. For foreign investors, for example, it is important to know the right type of company to register in Indonesia to the rights and eligibility of companies in owning business assets.

Local businesses have the option to establish PT, CV, or Micro Enterprises with relatively easier registration schemes. Local businesses are also given the authority to fully own property (Ownership Rights), while for foreign investors the process tends to be more complex.

As a company labelled as Foreign Direct Investment (PMA), foreign investment is only allowed to lease property instead of owning it.

While you look at the advantages and disadvantages in the next section, consider which factors are most important to you and how much weight they carry when making a decision.

Understanding the Pros and Cons of Leasing System

The leasing system, or leasing, is a popular alternative to direct asset purchase. The main advantages of the leasing system are low initial commitment, flexibility, and ease of maintenance. However, on the other hand, you do not have full rights to the asset and cannot build equity.

Advantages:

- Low initial capital: No need to pay a large down payment, you just need to pay a deposit.

- Tax savings: Leasing costs are generally deductible as tax deductions.

- Management by lessor: The asset owner or lessor is responsible for repairs and maintenance, saving you time.

- Customization possibility: Some lessors are willing to modify assets to suit your needs.

- Premium location: The leasing system allows you to occupy locations that may be too expensive to own.

- Credit improvement: Cash flow from leases usually helps improve your business credit rating.

- Subsidized utilities: Lessors often contribute to certain utilities, such as waste management, water, or cleaning services.

- Mobility: Easier to relocate if you feel the leased asset no longer meets your needs.

Disadvantages/Considerations:

- If you use a broker's services, there will be annual broker fees during the lease term. These fees are usually a percentage of the total annual lease cost and can be negotiated.

- Lease costs tend to increase when you extend the lease contract.

- You rely on the landlord's timeliness and quality of repairs. This can be a source of frustration, especially for companies like construction firms.

- The building owner may have rules about the use and condition of outdoor areas that can affect your ability to store vehicles and materials. Make sure to discuss this beforehand.

- Even though you currently have a good landlord, the situation may change in the future.

Advantages and Disadvantages of Buying Property

Buying property, whether it's a house, apartment, or land, can be a significant financial decision. Understanding its advantages and disadvantages will help you make the right choice.

Advantages

- Building Wealth (Equity): Every instalment payment builds equity. This can be a valuable asset for future loans.

- Extra Income: Have extra space? You can rent it out for additional income.

- Fixed Instalments: Mortgage instalments are generally fixed, providing long-term financial stability.

- Tax Deduction: Mortgage interest can be deducted from taxes, saving costs in certain contexts.

- Building Depreciation: You can claim building depreciation, potentially increasing tax deductions.

- Modification Freedom: Free to renovate as desired (within local regulations).

- Full Control: You determine what happens on your property.

- Long-term Investment: When you retire, the property can be sold, and the profits can support your life.

Disadvantages

- Buying property requires a significant initial cost, including a down payment, administrative fees, and property agent fees.

- The money you invest in property can potentially be used to develop your business in other ways. It is important to carefully consider this trade-off.

- As an owner, you are responsible for renovation, repair, and regular building maintenance costs.

- If your space needs increase over time, you need to sell the old property and look for a larger one.

Freehold/Leasehold? Know the difference between these two terms in Indonesian property here: Right to Build vs. Ownership: Understanding the Differences for Your Right Property Decision

Financial Considerations

A stable location in the long term generally makes 'buying' more cost-effective than 'renting' an office space. Before deciding, it is best to conduct a cost analysis for a certain period. Consider the following:

- Mortgage vs. Rent: Compare the amount of routine costs.

- Insurance: The property you own needs insurance coverage.

- Down Payment (DP): When buying, 10-25% of the price must be paid upfront.

- Tax: Consider tax deductions whether renting or owning property.

- Routine Maintenance: Prepare around Rp 20,000/square meter/year for maintenance and repairs.

- Equity: Having property does form equity, but the resale value is difficult to predict.

- Biaya Kesempatan (Opportunity Cost): Pertimbangkan berapa dana yang dapat menghasilkan keuntungan bila diinvestasikan ke dalam usaha Anda. Bandingkan antara besaran DP properti dengan perbedaan biaya sewa dan cicilan (pilih opsi yang lebih mahal).

- Deposit Jaminan: Besarnya deposit pada saat sewa.

- Fee Broker: Biaya jasa broker properti. Umumnya tahunan bila menyewa, sekali bayar bila membeli.

- Jasa Pengacara: Diperlukan untuk negosiasi sewa. Bila membeli, biasanya termasuk dalam komisi agen properti.

- Biaya Penutupan Transaksi: Tambahan biaya yang muncul saat membeli properti.

- Renovasi: Hitung perkiraan biayanya.

- Utilitas: Bila saat sewa, biaya-biaya seperti listrik dan air sudah termasuk, maka biaya ini perlu ditambahkan ke dalam perhitungan ketika Anda memilih membeli properti.

Membeli Office Space menggunakan skema KPR

Jika anda sudah memantapkan hati untuk membeli office space atau kantor di Indonesia namun belum memiliki keleluasaan untuk membeli secara kontan (hard cash), maka anda dapat menggunakan skema KPR.

Persyaratan Pengajuan KPR Kantor dan Office Space

Secara umum, persyaratan dan proses pengajuan KPR office space tidak jauh berbeda dengan KPR rumah. Berikut adalah beberapa persyaratan yang perlu dipenuhi:

- Have a fixed income that is sufficient to pay the mortgage instalments.

- Memiliki uang muka minimal 10% dari harga office space.

- Melengkapi dokumen yang diperlukan, seperti KTP, KK, slip gaji, dan bukti penghasilan.

Proses pengajuan KPR office space dapat dilakukan melalui bank atau lembaga keuangan yang menyediakan produk KPR office space.

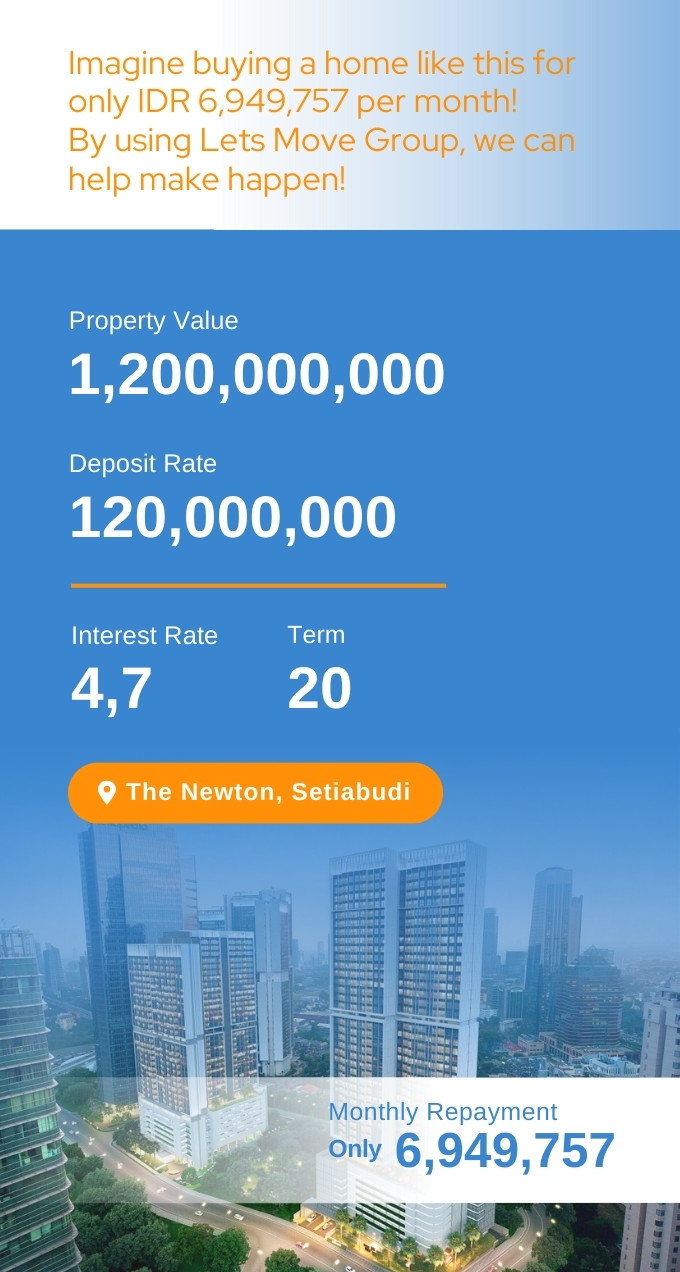

Investasi Office Space dengan Skema KPR Bersama Lets Move Group

Lets Move Group memahami kebutuhan Anda akan ruang kantor yang ideal untuk mengembangkan bisnis. Kami menawarkan solusi Kredit Pemilikan Ruang Kantor (KPR) yang memudahkan Anda memiliki office space yang anda inginkan.

- Temukan office space yang sesuai dengan kebutuhan dan anggaran Anda melalui website Lets Move Group atau dengan bantuan tim profesional kami.

- Tim Lets Move Group membantu Anda dalam proses pengajuan KPR ke bank pilihan Anda.

- Setelah KPR disetujui, bank akan mencairkan dana untuk pembelian office space.

- Anda mencicil KPR setiap bulan sesuai dengan jangka waktu yang disepakati.

Lets Move Group memberikan berbagai keuntungan dalam proses pembelian office space dengan KPR:

- Akses ke berbagai pilihan office space

- Bantuan tim profesional

- Competitive interest rates

- Simulasi KPR

Hubungi Lets Move Group sekarang dan wujudkan mimpi Anda memiliki real estate ideal untuk semua kebutuhan anda!