For many Indonesians, owning property is a significant investment in life. Whether it's a residential house, apartment, or land, property can be a source of financial security and future stability.

However, behind the joy of owning property, often the essential aspect of property ownership is overlooked, namely preparation for the future, especially in terms of inheritance.

Creating an inheritance deed is a crucial step often overlooked by many property owners in Indonesia. Yet, having a valid and detailed inheritance deed is crucial to ensure the smooth process of passing property ownership to the next generation.

Why is an Inheritance Deed Important?

Here are some reasons why an inheritance deed is important in property ownership in Indonesia

Legal Protection

One of the main reasons for creating an inheritance deed is to provide legal protection for property owners and their heirs. By having a valid inheritance deed, property owners can ensure that their property is legally protected and will be passed on according to their wishes after their passing.

Without a valid inheritance deed, property ownership rights can become a source of conflict among heirs. This can result in lengthy and expensive legal proceedings, as well as trigger tension within the family. By having a clear and valid inheritance deed, potential conflicts can be minimized, and property owners can have peace of mind.

Here, we summarize the importance of creating an Inheritance Deed in the property world in Indonesia.

Clear Ownership

In many cases, properties are owned by several family members or business partners. In such situations, it is important to have a clear inheritance deed to determine how the property will be divided if one of the owners passes away. Without a valid inheritance deed, property ownership can become unclear and trigger conflicts among the remaining owners.

By creating an inheritance deed, property owners can clearly determine how the property will be passed on to their heirs. This ensures that the property owner's wishes are respected and that the inheritance process runs smoothly without obstacles.

Protection Against Third-Party Claims

Without a valid inheritance deed, owned properties can be vulnerable to claims from unauthorized third parties. This can happen if there are parties claiming ownership rights over the property that is actually owned by heirs. By having a valid inheritance deed, property owners can protect their property from unauthorized claims and keep their ownership rights secure.

Legal Certainty

Creating an inheritance deed also provides legal certainty for all parties involved. By having a valid inheritance deed, heirs can be confident that they have legitimate rights to the property. This also provides certainty for other parties involved in property transactions, such as banks or financing providers.

Smooth Inheritance Process

Finally, creating an inheritance deed can help streamline the property inheritance process. With a valid inheritance deed, heirs can easily handle all the necessary documents to transfer property ownership to their names. This can save time and costs associated with the inheritance process, as well as reduce the stress and tension associated with legal administration.

To ensure that your property is protected and can be smoothly passed on to your heirs, it is crucial to create a valid and detailed inheritance deed. By doing so, you can provide legal protection for yourself and your heirs, as well as ensure the smooth inheritance process of your property in the future. Do not hesitate to consult with legal professionals or notaries for assistance in creating the right inheritance deed for your property.

How to Draft a Property Inheritance Deed through Legal Consultants

Here are the general steps in drafting an inheritance deed through legal consultants:

Initial Consultation

The first step is to arrange a meeting with a legal consultant to discuss your inheritance situation. At this stage, you can provide information about the deceased, heirs, and inherited assets that need to be included in the inheritance deed.

Document Collection

After the initial consultation, the legal consultant will guide you to collect the necessary documents, such as birth certificates, death certificates of the deceased, wills, and other relevant documents.

Document Analysis

The legal consultant will conduct a thorough analysis of the documents you provide to ensure the validity and accuracy of the information stated in the inheritance deed.

Drafting the Inheritance Deed

Once the documents are validated, the legal consultant will start the process of drafting the inheritance deed. This document will include details about the deceased, heirs, and the share of inheritance owned by each heir.

Also read: Property Legality in Indonesia: Home Sale and Purchase Process with Notary

Submission and Verification

After the inheritance deed is completed, the legal consultant will submit the document to the relevant institution for verification. This verification process ensures that the inheritance deed meets the applicable legal requirements.

Completion and Document Retrieval

Once the inheritance deed is verified, the legal consultant will assist you in completing the process and retrieving the document. A valid inheritance deed will be provided to you for use in transactions or settlement of inheritance assets.

By using the services of legal consultants, you can ensure that the process of drafting an inheritance deed runs smoothly and complies with applicable legal requirements.

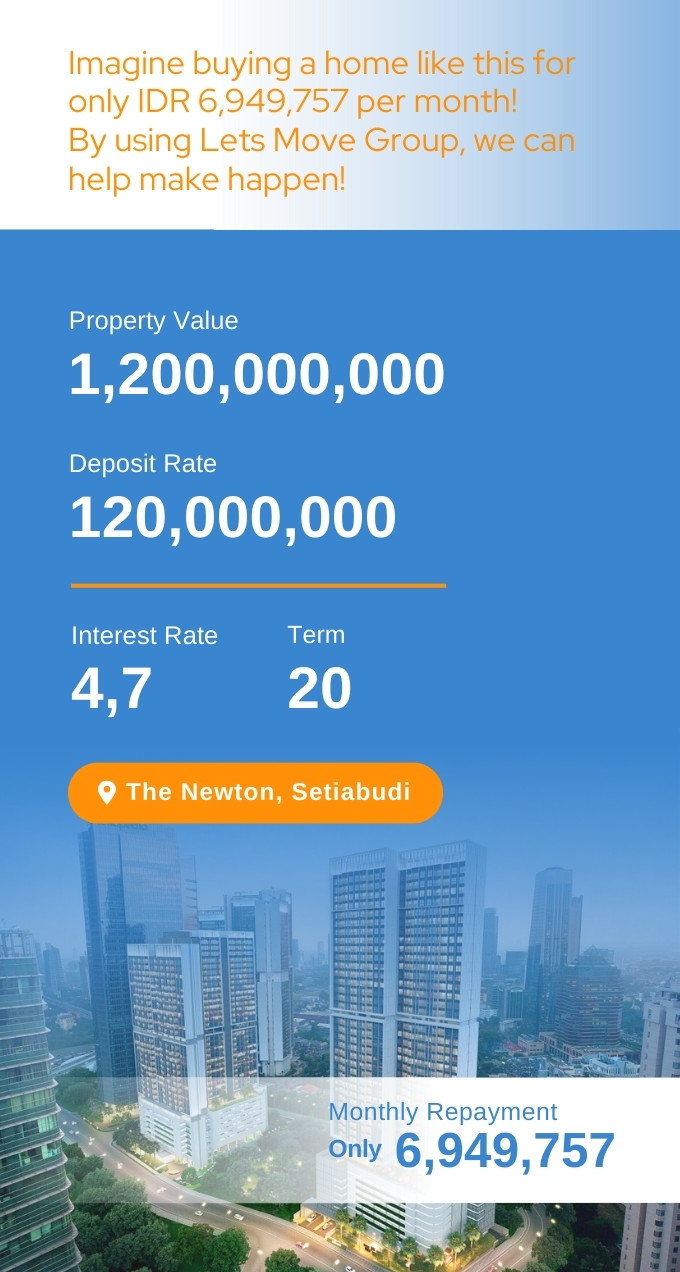

Drafting Property Inheritance Deeds with Lets Move Group

The process of inheriting property can be complex and full of questions. Without careful preparation, this process can lead to disputes among heirs. Lets Move Group is here to help you draft Property Inheritance Deeds easily and safely. Lets Move Group hadir untuk membantu Anda menyusun Akta Waris Properti dengan mudah dan aman.

Our professional team will help you understand inheritance law in Indonesia and guide you through the process of drafting Property Inheritance Deeds.

Contact Lets Move Group now and get the best solution for drafting your Property Inheritance Deeds.