- Jakarta Office

- Seminyak Office

- Canggu Office

- Sanur Office

Lets Move Group is proud to present innovation in the world of property! We are the pioneers of Indonesia's first free KPR agent service.

Make your new home dreams come true with trusted property experts, Lets Move Group.

This is the best mortgage solution for you! Get a free consultation with an expert mortgage consultant who understands your needs personally.

Together with the first KPR broker in Indonesia, make your dream of owning your dream home come true and save money!

Contact us now!

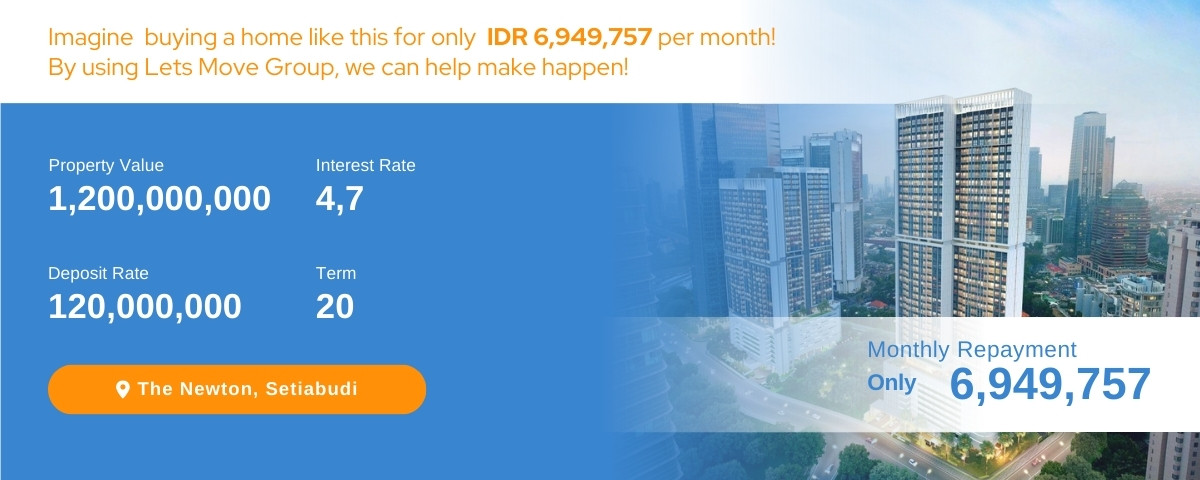

Use the Lets Move Group mortgage calculator to see the estimated value of your potential dream home and how much you can borrow!

Need help planning your finances? Don't hesitate to contact our friendly team to schedule a free consultation with one of our experienced Financial Consultants.

Anda dapat memilih bertemu langsung di salah satu dari 4 kantor kami di Jakarta atau Bali, atau melalui telepon – sesuai dengan kenyamanan Anda.

Our team will listen carefully to your individual needs, answer any questions you have, and offer you the best options to suit your circumstances.

If you are interested in continuing, our team is ready to help arrange the documents and guide you until the mortgage application process is complete!

Our advice and time is completely free. We are paid by banks and mortgage providers to refer clients. We only ask for a signed cooperation agreement before providing the consultation.

Yes, foreigners can get a mortgage in Indonesia, but there are additional requirements and not all banks cater to mortgage lending for foreigners.

This depends on your situation and preferences. Our role is to provide all the information you need to make an informed decision. Ultimately, it's up to you to choose the mortgage that works best for you.

Outside of Indonesia, mortgage brokerage services are quite common, but historically in Indonesia, people got their mortgages directly from their banks. Our founder, Gary Joy, has been in the mortgage brokerage business since 2006 and has helped hundreds of people get the best mortgages during that time.

We have 4 offices in Jakarta and Bali, namely Kuningan Jakarta, Seminyak Bali, Canggu Bali, and Sanur Bali. If you would like to speak directly with our team, please fill out the contact form and we can arrange a face-to-face meeting or over the phone. Please note, we can offer our services throughout Indonesia, not just in our office locations.

The loan amount you get depends on a few key factors, mainly your monthly income and net income. To find out, please contact our team and get a free personalized consultation.

2024 is shaping up to be a dynamic year for the Indonesian property industry. While the residential property market is showing relative stability, with the composite-16 property price index rising only 1.74% throughout 2023, the expat property sector is experiencing a gradual uptick in early 2024 […]

Owning an apartment is a popular housing choice nowadays. However, before purchasing one, it's important to understand the differences between the Strata Title Certificate for Apartment Units (SHMSRS) and the Building Ownership Certificate (SKGB).

For many Indonesians, owning property is a significant investment in life. Whether it's a residential house, apartment, or land, property can be a source of financial security and future stability.

Finding the ideal home in South Jakarta, a vibrant and glamorous metropolitan area, can be an adventure. For those who are not ready to make a long-term commitment, have high mobility, or want to try living in various locations, it is better to rent a property in Jakarta than to buy. Renting offers flexibility and convenience, allowing you to relocate with ease [...].

Purchasing property in Indonesia with PT PMA, is it possible? A PMA, or Foreign Investment Company, is a form of legal entity that can be used by foreign investors to own a company in Indonesia. In addition to its corporate function, PT PMA is also said to be the safest way for foreigners to own property in Indonesia. PT PMA allows foreign companies to [...]

Home Ownership Loan (KPR) is a financial solution for individuals who want to own a house without having to spend all the funds at once. Mortgages generally use personal assets as collateral, but is it possible to pledge company assets for a mortgage? The answer is yes, a mortgage with company assets as collateral is possible. However, there are several things to consider, such as the type of legal entity of the company and the provisions [...]

Our journey started in 2016 with the sole aim of becoming the most ethical property and real estate agent in Indonesia. Our dream is to be a complete solution for the needs of expatriates, offering comprehensive solutions for property investment in Indonesia. Find Out More »

Enter your email address to get the latest updates and offers.

Copyright © Lets Move Group 2024.

Lets Move Group

Rate information

Interest rate is 4.7% fixed for the first 3 years, after that, the rate will move to a floating rate (currently 11%)

Requirements

General Personal Requirements

*Disclaimer