- Jakarta Office

- Seminyak Office

- Canggu Office

- Sanur Office

Lets Move Group is proud to present innovation in the world of property! We are the pioneers of Indonesia's first free KPR agent service.

Make your new home dreams come true with trusted property experts, Lets Move Group.

This is the best mortgage solution for you! Get a free consultation with an expert mortgage consultant who understands your needs personally.

Together with the first KPR broker in Indonesia, make your dream of owning your dream home come true and save money!

Contact us now!

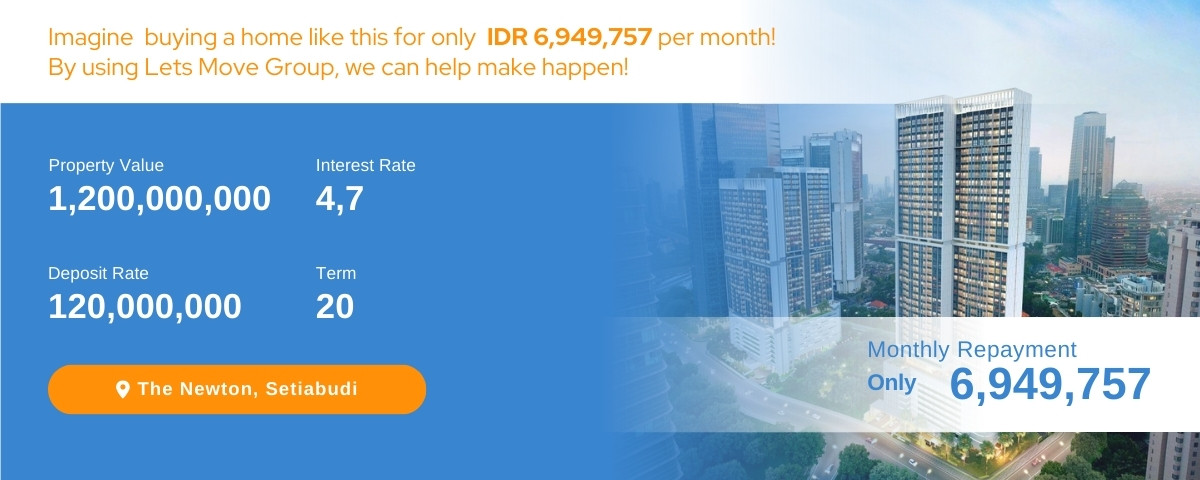

Use the Lets Move Group mortgage calculator to see the estimated value of your potential dream home and how much you can borrow!

Need help planning your finances? Don't hesitate to contact our friendly team to schedule a free consultation with one of our experienced Financial Consultants.

Anda dapat memilih bertemu langsung di salah satu dari 4 kantor kami di Jakarta atau Bali, atau melalui telepon – sesuai dengan kenyamanan Anda.

Our team will listen carefully to your individual needs, answer any questions you have, and offer you the best options to suit your circumstances.

If you are interested in continuing, our team is ready to help arrange the documents and guide you until the mortgage application process is complete!

Our advice and time is completely free. We are paid by banks and mortgage providers to refer clients. We only ask for a signed cooperation agreement before providing the consultation.

Yes, foreigners can get a mortgage in Indonesia, but there are additional requirements and not all banks cater to mortgage lending for foreigners.

This depends on your situation and preferences. Our role is to provide all the information you need to make an informed decision. Ultimately, it's up to you to choose the mortgage that works best for you.

Outside of Indonesia, mortgage brokerage services are quite common, but historically in Indonesia, people got their mortgages directly from their banks. Our founder, Gary Joy, has been in the mortgage brokerage business since 2006 and has helped hundreds of people get the best mortgages during that time.

We have 4 offices in Jakarta and Bali, namely Kuningan Jakarta, Seminyak Bali, Canggu Bali, and Sanur Bali. If you would like to speak directly with our team, please fill out the contact form and we can arrange a face-to-face meeting or over the phone. Please note, we can offer our services throughout Indonesia, not just in our office locations.

The loan amount you get depends on a few key factors, mainly your monthly income and net income. To find out, please contact our team and get a free personalized consultation.

In July 2025, news spread widely that abandoned land in Indonesia could be confiscated by the state if left vacant for two years. This issue became a hot topic of discussion due to concerns from landowners, especially those who inherited land or owned property far from where they lived. Don't panic if you have untouched land assets

Pemerintah Indonesia secara resmi memperpanjang insentif Pajak Pertambahan Nilai Ditanggung Pemerintah (PPN DTP) 100% hingga akhir tahun 2025. Kebijakan ini adalah langkah strategis yang memiliki dampak signifikan, bisa dilihat dari menstimulasi pertumbuhan ekonomi hingga membantu masyarakat mewujudkan impian memiliki rumah. Disini kita akan bahas apa itu fasilitas PPN DTP 100%, manfaatnya bagi berbagai pihak, serta […]

Understand the Differences Between Sharia and Conventional Mortgages Buying your dream home is a major financial decision for most people, and a mortgage is the most common way to make it happen. In many countries, including Indonesia and the UK, buyers can choose between sharia mortgages and conventional mortgages. Although both are designed to help individuals purchase property, they operate on different financial principles.

Dengan semakin pesatnya pembangunan properti seperti apartemen, hadirnya fasilitas pembiayaan seperti Kredit Pemilikan Apartemen (KPA) menjadi solusi yang tepat untuk membeli unit apartemen. Namun, apa sebenarnya KPA itu dan bagaimana cara mengajukannya? Disini kita akan mengetahui lebih lanjut tentang KPA, mulai dari definisinya, syarat-syarat yang dibutuhkan, hingga panduan langkah demi langkah untuk pengajuannya. Apa itu […]

For Indonesians who are looking for a home or seeking ways to improve the quality of their homes, there is something called BSPS. BSPS, or Bantuan Stimulan Perumahan Swadaya (Self-Help Housing Stimulus Assistance), is a government programme aimed at improving the quality of homes for low-income communities (MBR) in Indonesia. This programme

Membeli rumah adalah impian banyak orang. Prosesnya pun tidak mudah, butuh waktu, tenaga, dan tentunya dana yang tidak sedikit. Kredit Pemilikan Rumah (KPR) hadir sebagai solusi untuk mewujudkan impian tersebut. Namun, tidak jarang di tengah jalan, Anda dikejutkan dengan cicilan KPR yang tiba-tiba melonjak. Jika hal ini terjadi pada Anda, jangan panik! Mungkin Anda salah […]

Our journey began in 2016, with the sole aim of being the best real estate agency in Indonesia. Over time, as our business grew and developed, we began to focus on real estate finance solutions and revolutionised the property finance industry in Indonesia. Find Out More»

Enter your email address to get the latest updates and offers.

© Copyright 2025 PT Klub Rumah Baru

Lets Move Group

Rate information

Interest rate is 4.7% fixed for the first 3 years, after that, the rate will move to a floating rate (currently 11%)

Requirements

General Personal Requirements

*Disclaimer