The classic question that often arises from prospective home buyers is: “When is the best time to buy property?”

Answer is: the best time is now. Why so? Let's discover why!

Property Prices Continue to Rise

As cities grow and housing demand increases, property prices rarely drop. The longer you delay, the more likely you'll pay more for the same type of home. Buying now means locking in a lower price before the next increase.

Property Price Index Table (2022–2025)

| Years | Property Price Index (2022=100) | YoY growth |

| 2022 | 100 | – |

| 2023 | 106 | +6% |

| 2024 | 112 | +5,7% |

| 2025 | 118 | +5,3% |

(Source: Global Property Guide, BPS)

Property prices in Indonesia show a steady upward trend, namely around 5–6% per year. This stability makes property a safer investment instrument compared to many other types of assets that tend to fluctuate.

Growth Driving Factors

There are several main factors that drive up property prices, including:

- BI Rate stability maintains investor confidence and public purchasing power.

- The development of large infrastructure such as MRT, LRT, and new toll roads will further improve regional connectivity.

- High demand in Greater Jakarta, both for housing and investment, keeps the property market vibrant.

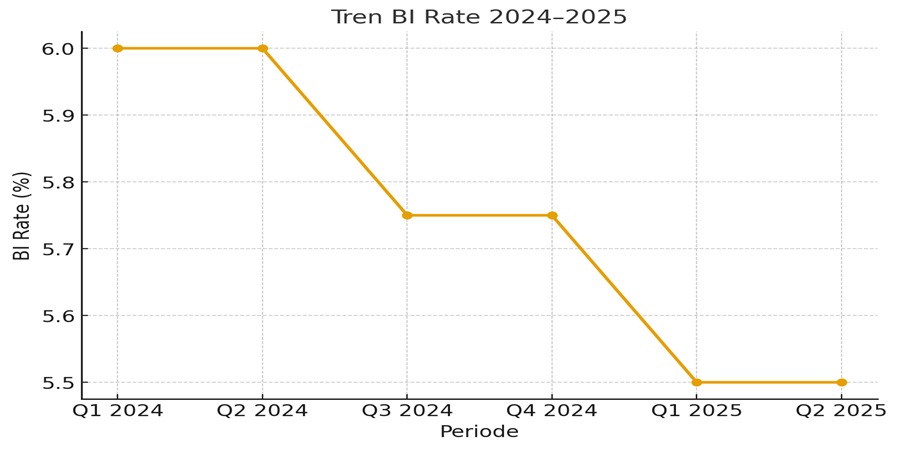

Interest rates are currently decreasing

Currently, the property market is benefiting from the trend mortgage interest rate reduction. This situation presents a significant opportunity for people to purchase a home with lower mortgage payments and lower interest rates.

Macro Outlook: BI Rate & Economic Conditions 2024–2025

- Bank Indonesia will begin lowering the BI Rate at the end of 2024.

- BI Rate falls from 6.0% to 5.5% in semester I 2025.

- This interest rate cut supports credit growth, including mortgages, thus boosting the property market.

Positive impact Buy a House Now for Consumers

Lower interest rates make monthly payments more affordable. This is especially helpful for first-time home buyers and investors because:

- Lower monthly instalments increase purchasing power.

- Access to financing is easier because the credit-to-income ratio (Debt Service Ratio) is healthier.

- The opportunity to accelerate asset ownership, with more efficient total interest costs in long-term investments.

Your Finances Are Secure! Mortgage Instalments Are Lower If You Start Early

With a Home Ownership Loan (Honours Loan) scheme, the sooner you decide to purchase and own your dream home, the longer the term you can choose. This means lower monthly instalments and a more manageable financial plan. Delaying will only shorten the term and increase the instalments.

Example: House price IDR 1 billion, DP 20%, Loan ceiling (KPR) IDR 800 million.

Fixed interest assumption 8% per year.

| Mortgage tenor | Estimated Monthly Instalments | Notes |

| 10 Years (120 Months) | ± Rp 9,7 Mio/Month | Large instalments, short tenor |

| 15 Years (180 Months) | ± Rp 7,6 Mio/months | Lighter instalments |

| 20 Years (240 months) | ± Rp 6,7 Mio/months | The lightest instalments compared to the previous tenors |

- If you start early, you can take long tenor, monthly instalments become lighter.

- If you delay, your age will increase, the tenor permitted by the bank will automatically be shorter, and the monthly instalments will be larger.

More Unit Choices

Good properties usually sell quickly. If you wait too long, the best unit in a prime location may already be snapped up. Buying now gives you the opportunity to secure a unit in the location, type, and price that best suits your needs, with peace of mind.

Want to know how to buy Property Smarter?

Don't miss the event! Property Workshop: Smart Ways to Buy a House & Understanding Mortgage Schemes with The Lets Move Group (LMG).

In this workshop, you will learn:

- How to choose the right property according to your needs.

- Tips for calculating financial capabilities and mortgage instalments.

- Strategies to ensure your mortgage application is quickly approved by the bank.

- Legal insight for safer property transactions.

Event Details

Theme: Property Workshop – Smart Ways to Buy a House & Understanding Mortgage Schemes

Date & Time: Tuesday, September 30 – 7 PM WIB

Location: Broadway Bar & Lounge, Mega Kuningan

Price: Free (Limited seats)

Register now & secure your seat!

Register link click here

+62 811-8881-0407 (Kenny – Property Consultant)